Filing an insurance claim can feel like the obvious next step after damage to your property or an unexpected event. But depending on the size of the loss and your deductible, it is not always the most cost-effective move. Sometimes, paying for repairs yourself helps you avoid higher premiums or complications with your policy. Understanding when to file a claim, and when it is better to handle the expense on your own, can help you make informed decisions about protecting your home, farm, or belongings. In this article, we will cover common claim scenarios, the role your deductible plays, and why working with an Oakwood Mutual agent can help you avoid costly mistakes.

Filing an insurance claim can feel like the obvious next step after damage to your property or an unexpected event. But depending on the size of the loss and your deductible, it is not always the most cost-effective move. Sometimes, paying for repairs yourself helps you avoid higher premiums or complications with your policy. Understanding when to file a claim, and when it is better to handle the expense on your own, can help you make informed decisions about protecting your home, farm, or belongings. In this article, we will cover common claim scenarios, the role your deductible plays, and why working with an Oakwood Mutual agent can help you avoid costly mistakes.

When You Should Always File a Claim

Some situations clearly warrant filing a claim. These include:

- Major damage

If your home suffers serious damage from a fire, tornado, or storm, the cost of repairs can be overwhelming. Insurance is meant to protect you during these high-loss situations. - Liability situations

If someone gets injured on your property, such as a guest slipping on ice or a contractor falling from a ladder, you should report the incident. These situations can lead to legal action, and your liability coverage can help protect you from out-of-pocket legal costs. - Theft or vandalism

If someone breaks into your home, damages your property, or steals valuables, filing a claim can help cover replacement costs and restore security. You can also learn more about preventative steps in our home protection tips. - Farm equipment losses

If your farm relies on tools like tractors, hay balers, or irrigation systems, protecting them is crucial. In the event of fire or theft, having a properly documented and updated policy can help you recover faster. Read more in our blog on farm equipment insurance.

When It May Be Better to Pay Out of Pocket

In other situations, it might make more sense to handle the loss without filing a claim.

- Repairs cost less than your deductible

If your deductible is $1,500 and the total repair estimate is only $1,000, your insurance will not pay out anything. However, filing the claim may still show up on your record, which could affect your premium. - You have filed multiple claims recently

Insurance companies review your claim history. Filing too often in a short period can affect your renewal eligibility or increase your rate. For more on how this works, check out our guide on understanding policy renewals. - Damage is minor and non-structural

If a small branch cracks a decorative fence post or a water stain appears in a garage from a minor leak, paying for the repair might be more efficient. Filing a claim could end up costing you more over time than the repair itself.

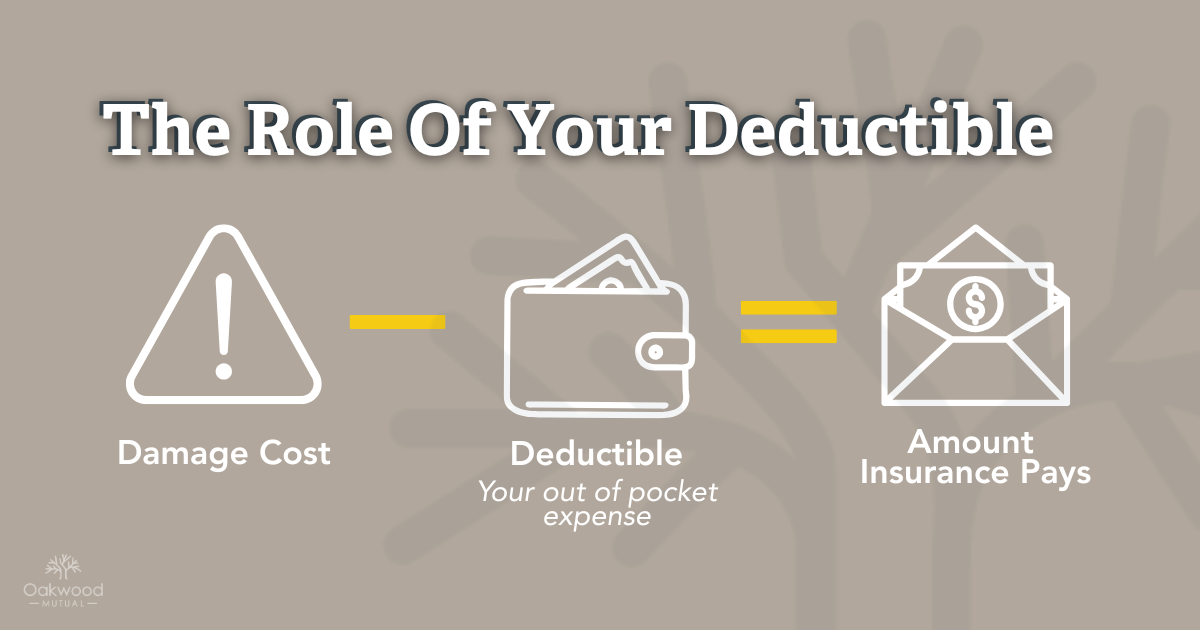

The Role of Your Deductible

Your deductible is the amount you are responsible for paying before your insurance coverage begins. Higher deductibles usually mean lower premiums, but they can also reduce the amount you receive from smaller claims.

For example, if you have a $2,000 deductible and your loss totals $2,500, you would only receive $500 from your insurer. In these cases, filing a claim may not be worth it.

To better understand how your policy’s deductible impacts your decisions, consider scheduling a personal insurance review.

The Risks of Filing Too Often

Your claims history can affect your premiums and renewal eligibility. While insurance exists to help in times of loss, filing claims for every minor issue can trigger rate increases or even a non-renewal notice.

Here are the potential consequences of filing too many claims:

- Loss of claim-free discounts

- Higher renewal premiums

- Increased scrutiny of future claims

- Possible policy cancellation

Avoid these pitfalls by reviewing your coverage regularly. If you are not sure whether to file a claim, contact a local Oakwood agent to help weigh the pros and cons.

Why You Should Talk to Your Agent First

Before submitting a claim, it is always a good idea to speak with your Oakwood Mutual agent. Our independent agents live in the same Indiana communities you do and understand how to guide you through this decision.

Your agent can help you:

- Confirm if the damage is covered

- Explain how filing may affect your premiums

- Review your policy’s deductible and coverage limits

- Provide insight on whether filing makes long-term sense

For additional preparedness, consider reviewing your home inventory checklist so you are ready if a loss occurs.

Timing Matters

Waiting too long to report a claim can be risky. Most policies require you to notify your insurer within a certain time frame after discovering a loss. If you wait too long, your claim could be denied.

This is especially important with:

- Water damage

- Storm-related losses

- Liability incidents

Damage that worsens over time may also reduce your chances of receiving full reimbursement. For help preparing for seasonal risks, check out our spring storms or winter home tips blogs.

Knowing when to file an insurance claim and when to pay out of pocket is not always a black-and-white decision. Every situation is different, and understanding your policy can help you make the right call. Filing unnecessary claims can cost you later. But avoiding claims when they are needed can leave you exposed. That is why your Oakwood agent is one of your most valuable resources.

Take time to talk to your agent, review your coverage regularly, and use helpful resources like our find an agent page to get the support you need.